Category: Inflation

-

EcoRodovias (ECOR3) Long-Term Investment Analysis

Business Overview and Concession Portfolio EcoRodovias Infraestrutura e Logística S.A. is one of Brazil’s largest toll road operators. As of 2025, the company operates 12 highway concessions spanning over 4,800 km across 8 Brazilian states . These toll roads connect key industrial, agricultural, and port regions, making EcoRodovias a critical player in Brazil’s logistics network.…

-

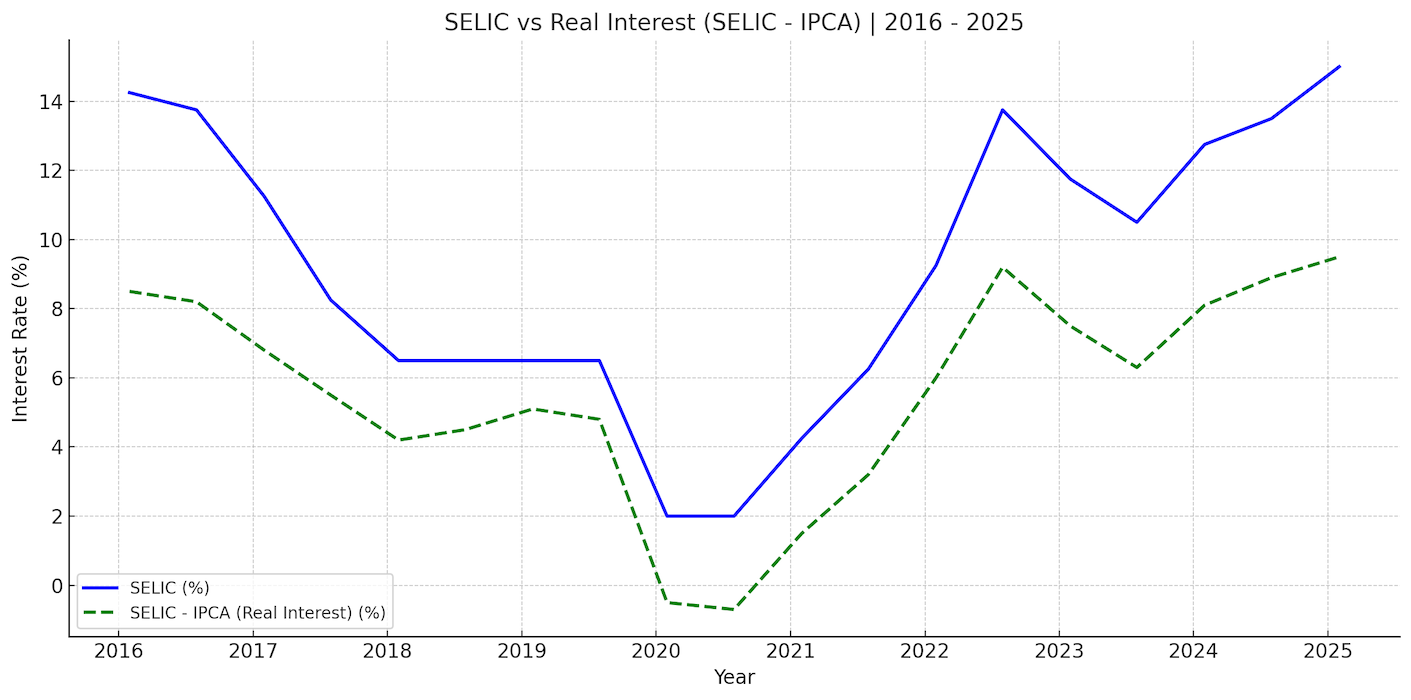

Brazil’s Central Bank Rate Hike to 15%: What It Means for Investors

Brazil’s Central Bank (Banco Central do Brasil, or BCB) raised the Selic interest rate by 25 basis points to 15% on June 18, 2025. This is now the highest interest rate in Brazil since 2006. The decision, made unanimously by the Monetary Policy Committee (Copom), signals not only the end of the current tightening cycle…

-

The Brazilian Stock Market in 2024: A Perspective on Politics, Policies, and Global Influences

Introduction As we navigate through 2024, the Brazilian stock market presents a fascinating study of the interplay between domestic politics, global economic trends, and policy reforms. This article delves into how various factors, including the Lula administration, the US elections, changing interest rates, and recent reforms, are shaping the trajectory of Brazil’s financial markets. The…

-

Copom reduces the basic interest rate of the economy to 13.25% per year

This is the first time the Central Bank (BC) has lowered the Selic rate in three years. The sharp decline in inflation led the Central Bank (BC) to cut interest rates for the first time in three years. By a 5-4 vote, the Monetary Policy Committee (Copom) reduced the Selic rate, the basic interest rate…

-

Exploring Investment Opportunities in Brazil’s Agricultural Sector

Brazil has established itself as a global agricultural powerhouse, renowned for its production of key commodities such as soybeans, coffee, sugarcane, and beef. With its vast arable land, favorable climate conditions, and technological advancements, Brazil offers a prime destination for agribusiness investments. In this blog post, we will delve into the investment opportunities in Brazil’s…

-

Navigating Brazil’s Legal and Regulatory Landscape: A Guide for Foreign Investors

Investing in Brazil offers attractive opportunities, but it’s essential for foreign investors to understand the legal and regulatory framework that governs their investments. In this blog post, we will explore the important aspects of Brazil’s legal and regulatory environment, including repatriation of funds, taxation, foreign ownership restrictions, and recent policy changes that impact foreign investors.…

-

Investing in Brazil: Unlocking Opportunities for Foreigners

Introduction:Investing in foreign markets can be an exciting endeavor, and Brazil stands out as a compelling destination for international investors. With its vibrant economy, abundant resources, and growing industries, Brazil offers a plethora of investment opportunities across various sectors. In this blog post, we will delve into the key factors that make Brazil an attractive…

-

Why interest rate is so high in Brazil and how can you take advantage of it?

Introduction The interest rate is the amount of money you pay to borrow money. It’s expressed as an annual percentage and it’s usually calculated on an annual basis, but sometimes it can be monthly or daily.Interest rates are very important for everyone who uses credit cards, loans or mortgages because they determine how much you…