Category: Macroeconomics

-

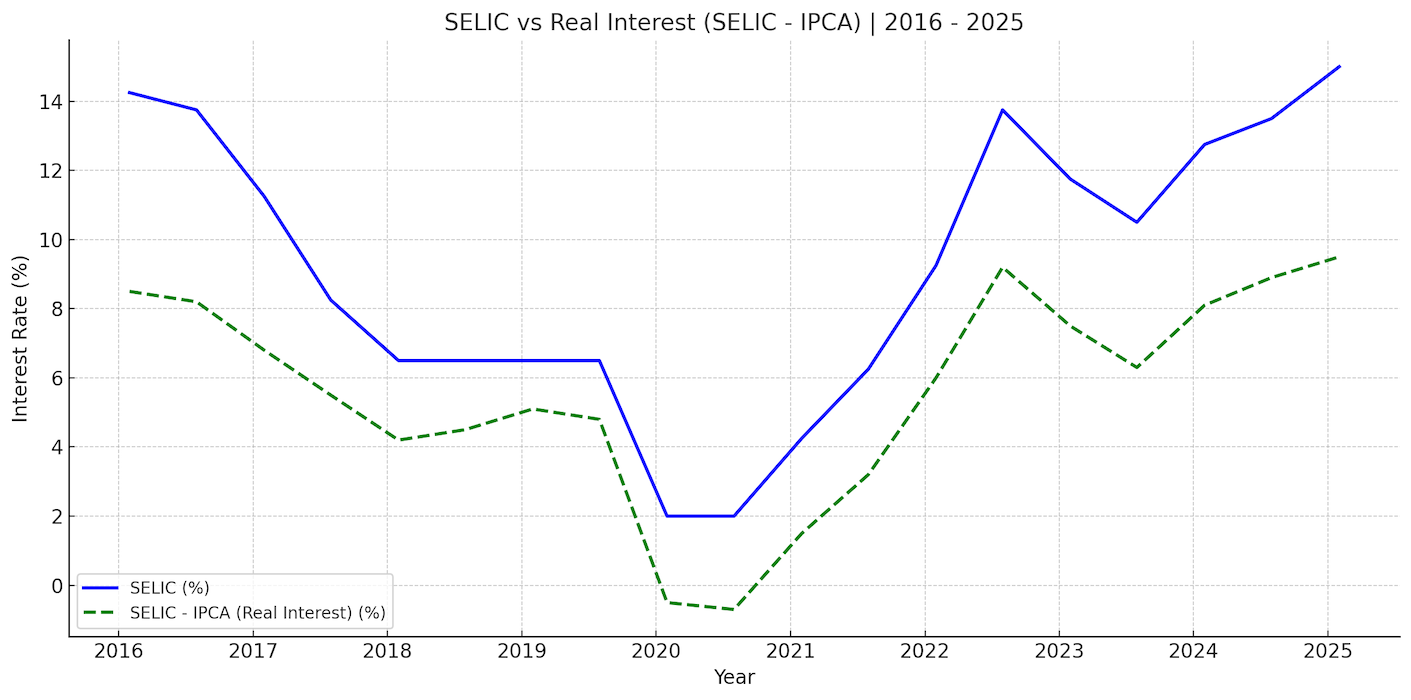

Brazil’s Central Bank Rate Hike to 15%: What It Means for Investors

Brazil’s Central Bank (Banco Central do Brasil, or BCB) raised the Selic interest rate by 25 basis points to 15% on June 18, 2025. This is now the highest interest rate in Brazil since 2006. The decision, made unanimously by the Monetary Policy Committee (Copom), signals not only the end of the current tightening cycle…

-

📈Ibovespa June 11, 2025

📈 Ibovespa at a Glance Top Gainers (Stocks with Best Daily Performance) Top Losers 🔍 Market Commentary & Technical Analysis Mini contracts (WIN, minidollar, mini-BTC): Summary

-

The Brazilian Stock Market in 2024: A Perspective on Politics, Policies, and Global Influences

Introduction As we navigate through 2024, the Brazilian stock market presents a fascinating study of the interplay between domestic politics, global economic trends, and policy reforms. This article delves into how various factors, including the Lula administration, the US elections, changing interest rates, and recent reforms, are shaping the trajectory of Brazil’s financial markets. The…

-

Trump Effect? Experts begin to see the first impacts of the American election on the markets

In his last term, the Republican increased protectionism and generated a trade war with China. Last Tuesday (16th), financial market experts pointed out that the American elections may have had an impact on the market. The overwhelming victory of former President Donald Trump in one of the first Republican Party primaries in Iowa is said…

-

Bank advises increasing exposure to the Brazilian stock market for the first time in three years.

The investment strategy committee of Itaú Unibanco that before suggested maintaining a neutral position in the domestic stock market, now recommends a position above neutral in August. The team recommended maintaining a neutral position in the domestic stock market and advised a position above neutral (+1, on a scale ranging from -3 to +3) in…

-

Lojas Renner (LREN3) is keeping an eye on lower price ranges to adapt to the new reality of Brazilian consumers

The company also mentions aiming for greater accuracy and better inventory management to overcome the challenging macroeconomic situation. Lojas Renner (LREN3) is adapting to the new reality of Brazilians after a period of high inflation and interest rates that eroded part of the population’s income. In an interview with InfoMoney after the second-quarter results of…

-

Copom reduces the basic interest rate of the economy to 13.25% per year

This is the first time the Central Bank (BC) has lowered the Selic rate in three years. The sharp decline in inflation led the Central Bank (BC) to cut interest rates for the first time in three years. By a 5-4 vote, the Monetary Policy Committee (Copom) reduced the Selic rate, the basic interest rate…

-

Ibovespa closed with a 1.46% increase on Monday and rose 3.27% in July. What drove the index’s growth?

The index registered its fourth consecutive month of gains, primarily driven by commodities-related stocks this time. In July, the Ibovespa closed with a 3.27% increase, marking its fourth consecutive monthly gain. On the last trading day of the month (July 31st), the main index of the Brazilian stock exchange rose, driven by commodity exporters and…

-

Brazil’s Economic Outlook and Emerging Trends: Opportunities for Astute Investors

Brazil’s economy, the largest in Latin America, continues to showcase resilience and growth potential. Amidst global economic shifts, the country presents a promising landscape for foreign investors. In this blog post, we will delve into Brazil’s current economic outlook and explore emerging trends that can significantly impact investment opportunities. We will examine government policies, infrastructure…